CQ Brief: May Edition

Stay up to date on the latest real estate trends.

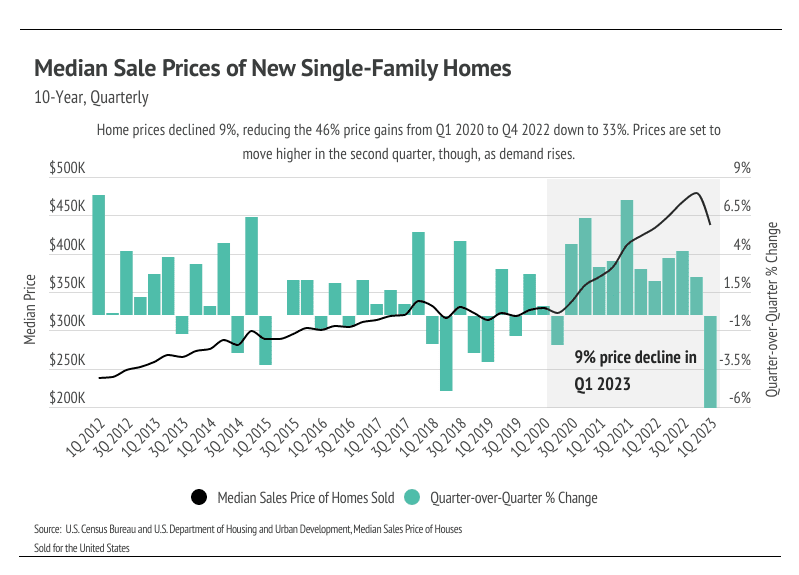

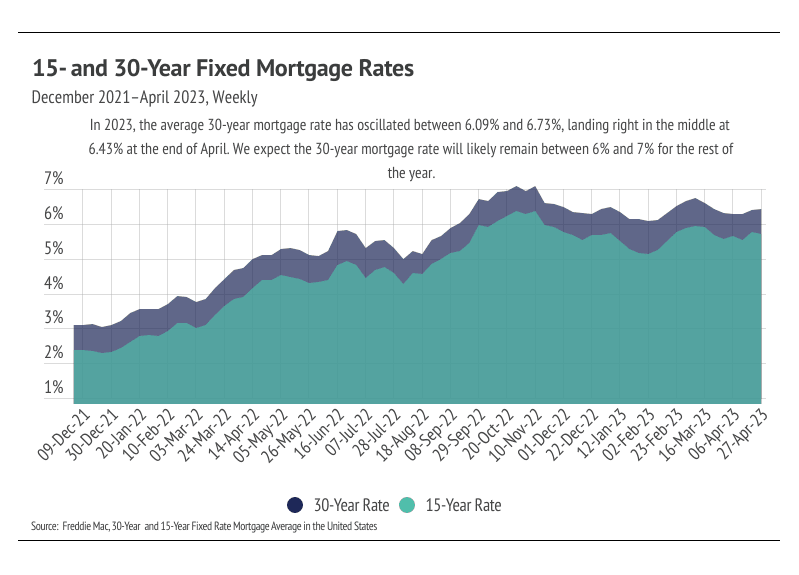

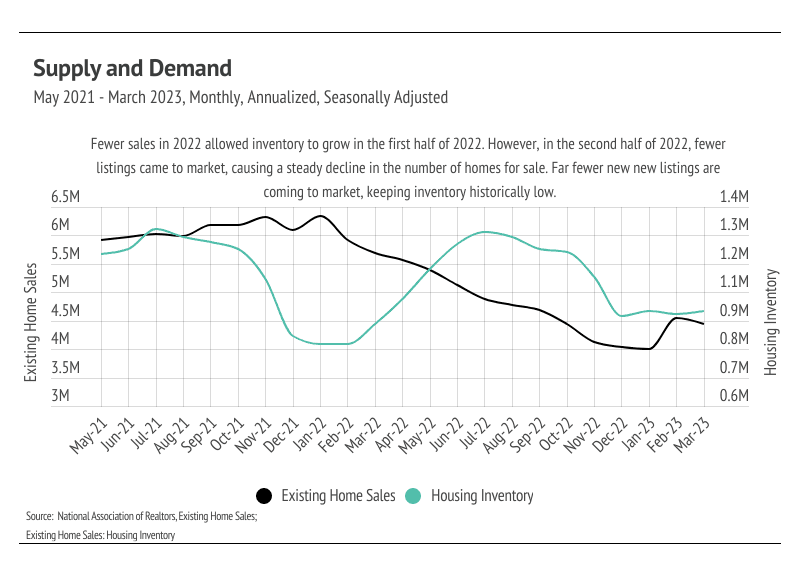

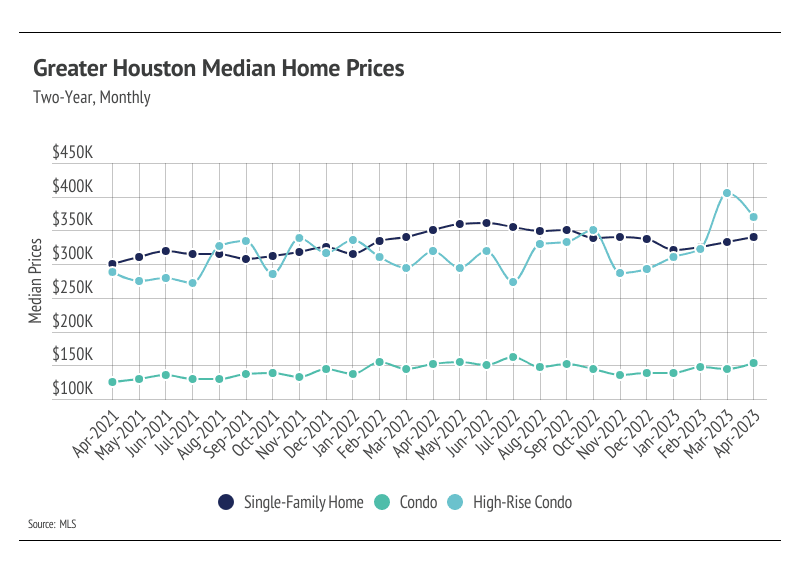

What's new, what's moving, what's next

A practical guide to choosing the right home in a buyer-friendly market

Your February Guide to Houston Real Estate, Neighborhoods, and New Year Opportunities

How Winter Buyers Gain Pricing Power, Better Terms, and a Head Start Before the Spring Rush

Your Guide to Houston Real Estate, Neighborhoods, and New Year Opportunities

A new year brings fresh goals, and for many Houstonians, buying a home in 2026 is high on the list. Whether it’s your first home, more space for your family, or a fres… Read more

Houston transforms into a festive wonderland every holiday season, offering dazzling light displays, immersive experiences, and family-friendly events across the city … Read more

If you’ve been thinking about buying a home in Houston, this season offers one of the most favorable market environments we’ve seen in years. A combination of improved… Read more

The holidays are here!—and with it comes hot cocoa, Christmas Lights, holiday spirit, and the New Year!🎆 We've got everything you need to make this season your bright… Read more

We’re Here to Guide You on Your Quest